Can states bend the teacher pension cost curve?

Pensions continue to eat into education budgets

When my friends at the Center for Reinventing Public Education asked me to write an essay about teacher pensions, I leaped at the chance. I had spent a good portion of my time at Bellwether building out an entire website on this topic (TeacherPensions.org), so I was excited to revisit it.

What I found is that the problems have not gone away. Far from it, in fact. While the rest of the education sphere has been talking about…lots of other things, pension costs have been quietly creeping upwards. I once dubbed this the “Pension Pac-Man” problem, because pensions are slowly but steadily eating up more and more of the money policymakers think they’re spending on education. The Equable Institute has called these “hidden funding cuts,” and they’re large.

How large? According to the latest figures I pulled for the CRPE piece, spending on teacher pension plans works out to about:

$83 billion per year

Almost $1,700 per student

A contribution rate equivalent to 20% of each teacher’s salary

To be clear, all of this money is NOT going to improve teacher benefits. The opposite, in fact. States are so overburdened from their past pension promises that they’ve cut benefits for new workers.

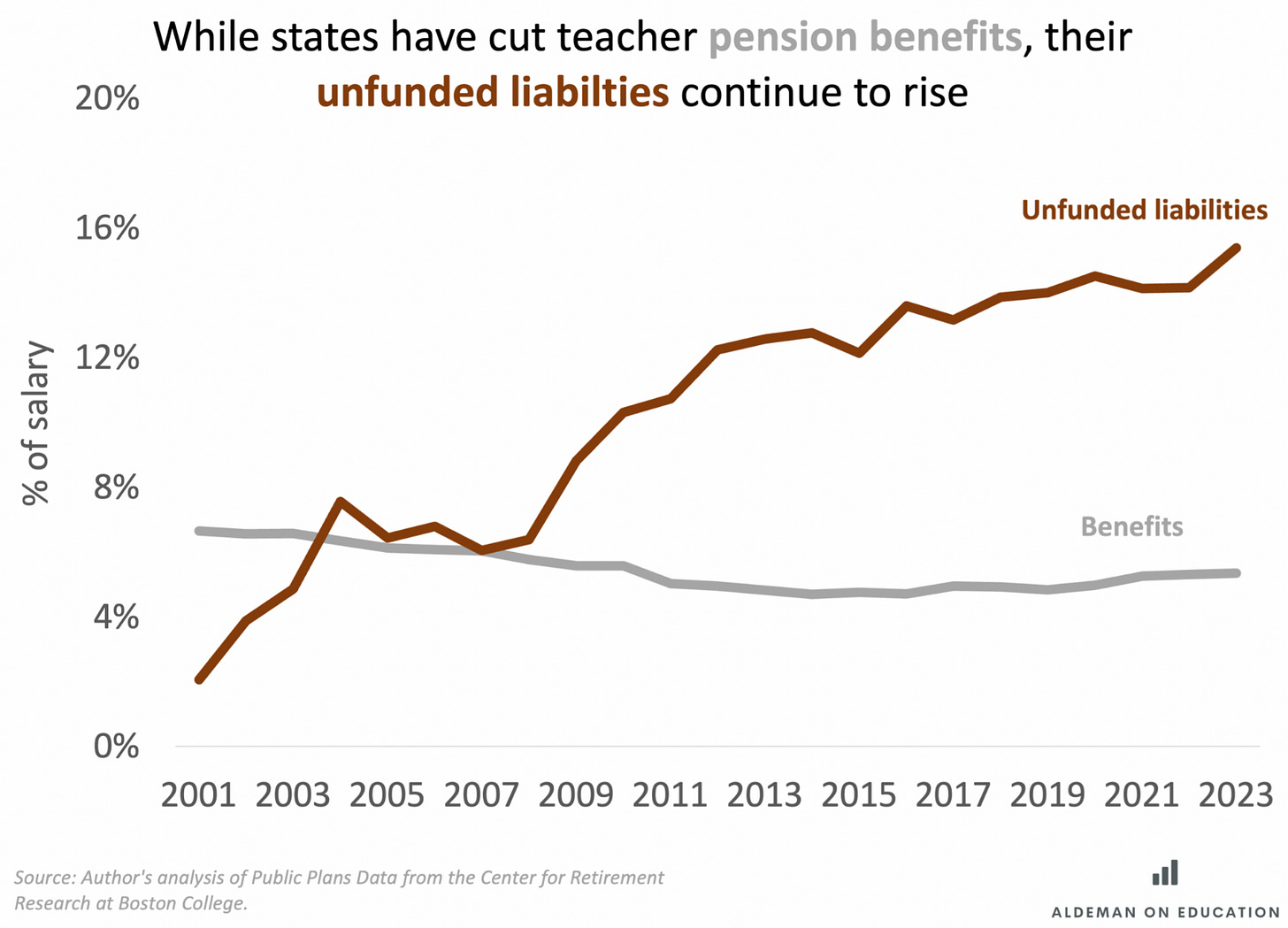

You can see this visually in the chart I prepared for CRPE. The cost of the benefits delivered to teachers and other education employees (in gray) comes out to an average benefit equivalent to about 5% of each worker’s salary. You can think of that as being slightly more generous than what the typical private-sector employer might contribute to employee 401k plans.

But now look at the red line. The cost of paying down unfunded liabilities has been on a steady upward trend for the better part of the last two decades. As of the most recent data, states and school districts are contributing 15% of each employee’s salary toward these unfunded liabilities.

So what can be done about these problems? In the CRPE piece, I note that the existing debts will have to be paid but argue that it should be state governments, not schools or districts, that bear the burden. Moreover, there are a variety of models from both the public and private sectors that do a better job of keeping costs at a reasonable level while still providing solid benefits to workers.

Right now, policymakers in too many states are ignoring their pension problems and praying that rising equity markets will somehow save them. This ostrich-like approach is not working, and state leaders need a better plan.

Read my full CRPE piece to see how to get there.

The NYS Constitution says, public employee pensions cannot be diminished

The IL pension may be the first test on pension beneficiaries or bond holders. It’s coming.